Fire Patrol Charges

Fire Patrol Charges

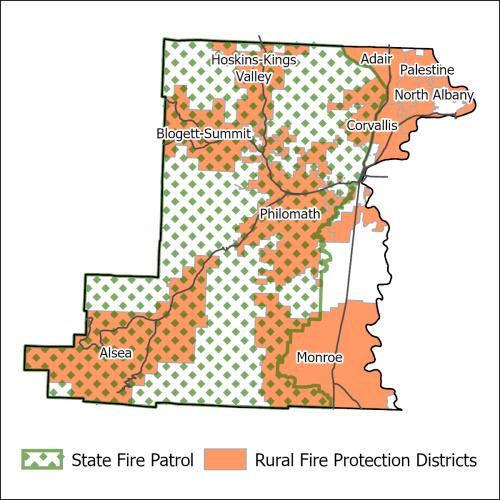

Some land in Oregon is at risk of catching fire because of the plants that grow there. The state government has a program to protect these lands from fire and to put out any fires that start. This program is called the forest protection district and it is run by the Oregon Department of Forestry. If you own land in this district, you have to pay a fee to help fund the program. You pay this fee to Benton County, and they send it to the state. On your tax statement, this fee is called “OR Forestry Fire.”

Some land in the forest protection district also has buildings on it that could burn in a fire. If you have buildings on your land, you have to pay another fee for local fire services. These are fire departments that are run by cities or rural areas. They charge you based on how much your buildings and some of your land are worth. The county assessor’s office will make a separate account for your land to keep track of these fees. This is called a fire patrol code split.

There are three kinds of fees that you might have to pay for fire protection:

- Local Fire District (City or Rural)

- Regular State Fire Patrol District

- State Fire Patrol Emergency Surcharge

- For More Info Visit The Oregon Department of Forestry

The Local Fire District fee is a tax that is based on how much your property is worth. It shows up as a line under the General Government section on your tax statement. The amount of this tax depends on the rate that was set by Measure 50 or by the voters in your area.

This is a summary of the state fire patrol charges that you may have to pay depending on your property type and location.

The state fire patrol regular district principal is a fee that you pay for the protection of your land from wildfires. The fee is based on how much land you own, but it is never less than $18.75.

The state fire patrol emergency surcharge is an extra fee that you pay if your property has a building or other structure that could be damaged by fire. The fee is $47.50 and it only applies to properties within the state forest protection district.

The local fire district charges are separate from the state fire patrol charges. They are for the protection of your property from other types of fires, such as house fires or grass fires. The local fire district charges vary depending on where you live and what services the local fire district provides.

Here are some examples of how these charges work for different kinds of properties:

- If you own a vacant land parcel within the state forest protection district, you only pay the state fire patrol regular district principal. You do not pay any local fire district charges or the state fire patrol emergency surcharge.

- If you own an improved parcel (with a building or structure) within the state forest protection district, and it is 5 acres or less, you pay all the charges: the state fire patrol regular district principal, the state fire patrol emergency surcharge, and the local fire district charges.

If you own a property that is partly or fully covered by the state fire patrol, you need to know how this affects your taxes. Here are some examples:

- If your whole property (20 acres) is in the state fire patrol area, you will pay two types of taxes: one for the land and the improvements (such as buildings) that are protected by the local fire district, and another for the land that is only protected by the state fire patrol. You will also pay a regular fee and an extra fee to the state fire patrol.

- If only part of your property (5 acres) is in the state fire patrol area, you will pay one type of tax for the land and the improvements that are protected by both the local fire district and the state fire patrol, and another type of tax for the land that is only protected by the local fire district. You will also pay a regular fee and an extra fee to the state fire patrol.

These are just some general examples. There may be different situations depending on your specific property.