Business Personal Property Start Return

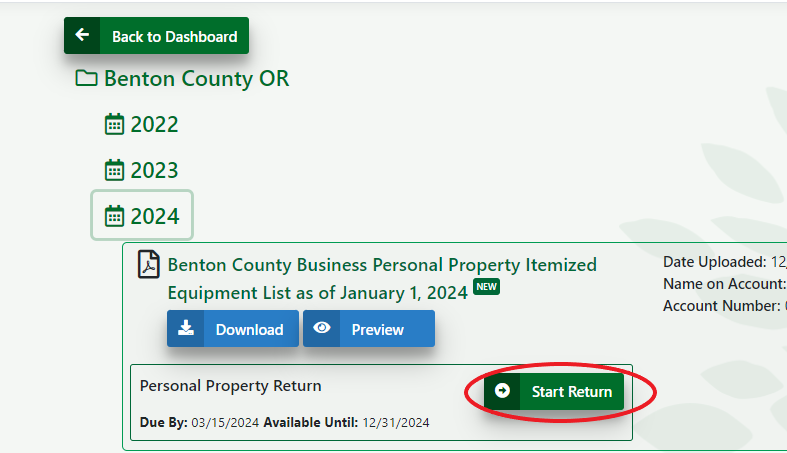

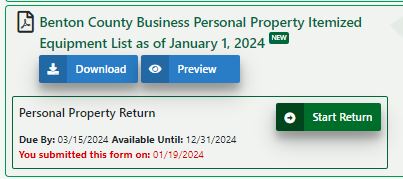

Start Return

1. Click on the Start Return button

Once you have started the return, you MUST finish the entire return as you will NOT be able to save and come back to the return, so make sure you have everything you need to file before you start.

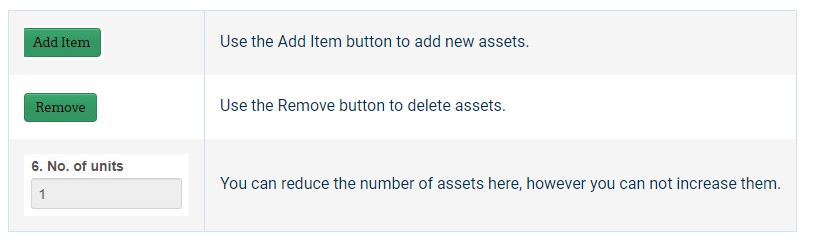

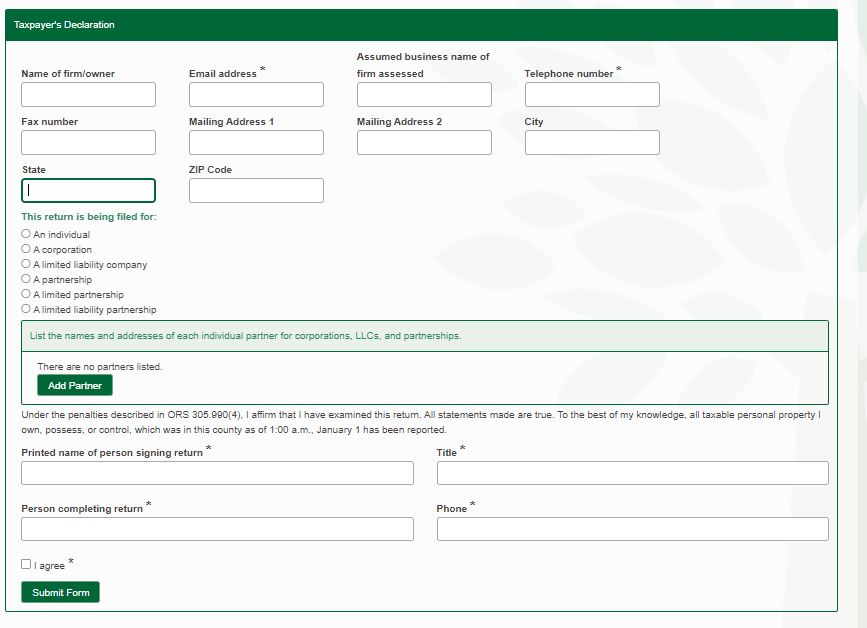

2. Fill out online form

The electronic return form is very similar to the paper version, however, please read all of the instructions on the form very carefully. Below are images of the add button and remove button for each of the sections on the return where you will add or remove assets.

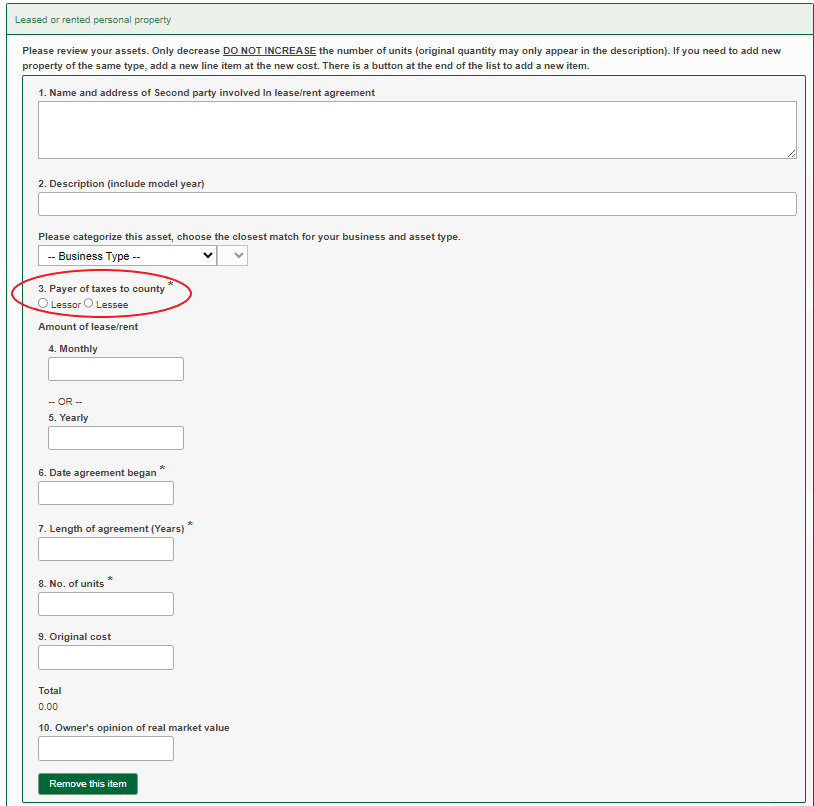

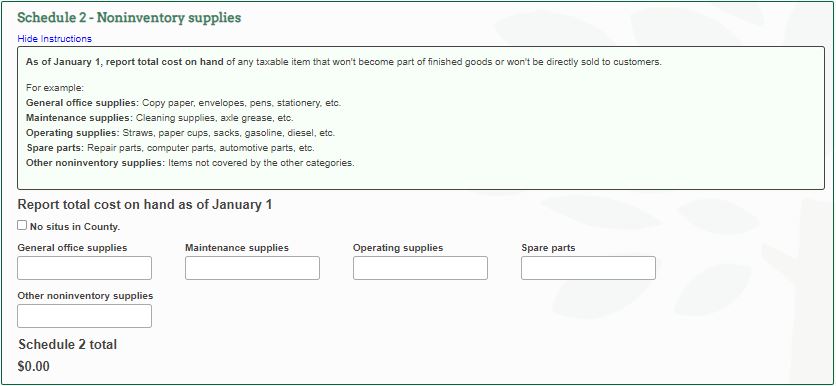

3. Leased Assets and Non-Inventory Supplies

Be careful when filling out these two sections.

Leased Assets need to have the lessee/lessor responsibility filled out.

Non-Inventory supplies is not the lump sum of all of your assets these are other supplies used to run your business (ie: paper, pens, supplies that are replaced when used)

4. Submit your Return

Fill out the required fields at the bottom of the forma nd click on Submit form when done.

Made an Error?

In your yearly folder you will see a message that you have submitted your return. If you realize you made an error on your return, you can click on the Start Return button and start over.

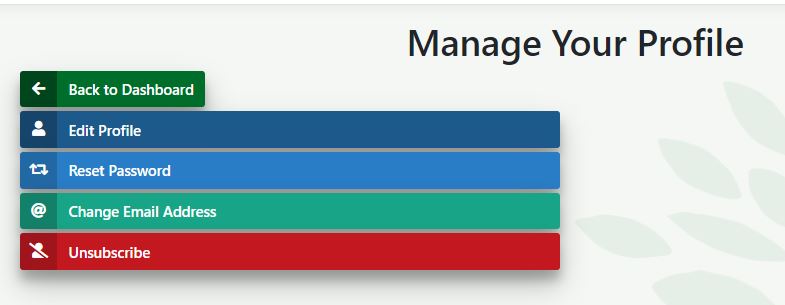

Opting Out of Electronic Tax Statements

If you would like to have your tax statements mailed to you in paper form you will need to:

• Complete your return and submit it

• Go back to the dashboard

• Select Manage profile

• Click the red unsubscribe button

Please remember if you don’t unsubscribe after you file your return your tax bills will come electronically.

Contact Us

• If you have lost your authorization code or have filing questions please contact: Benton County Department of Assessment via email: personal.property@bentoncountyor.gov or telephone at 541-766-6269.

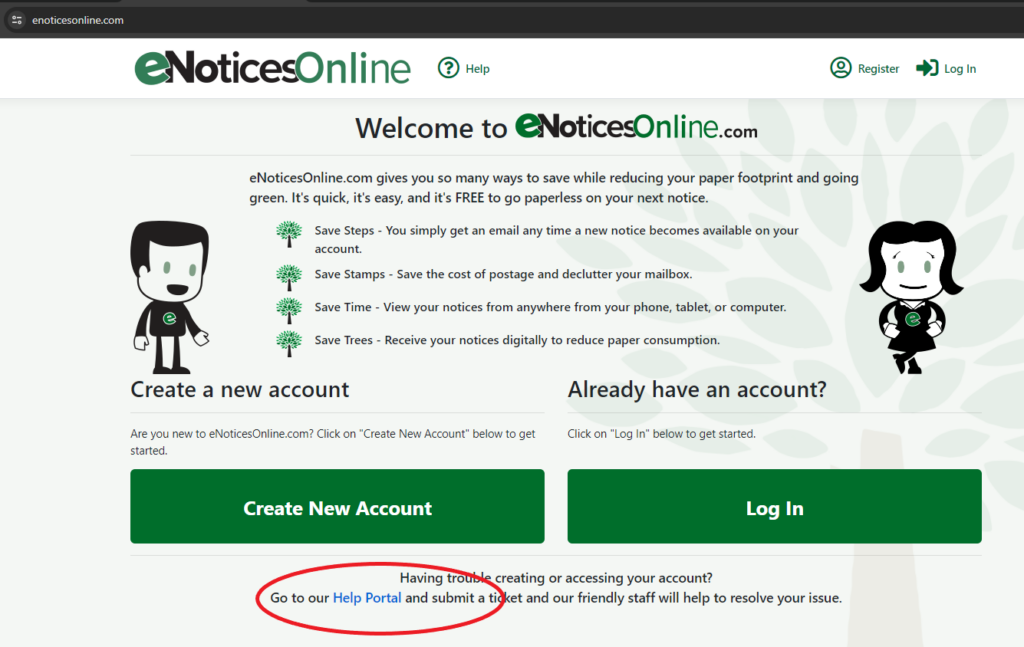

• For password issues, or functionality issues with eNoticesOnline please to help.eNoticesOnline.com, or you can submit a ticket from the help menu on the eNoticesOnline homepage.