Business Personal Property First Time Set-up

First Time Set-up

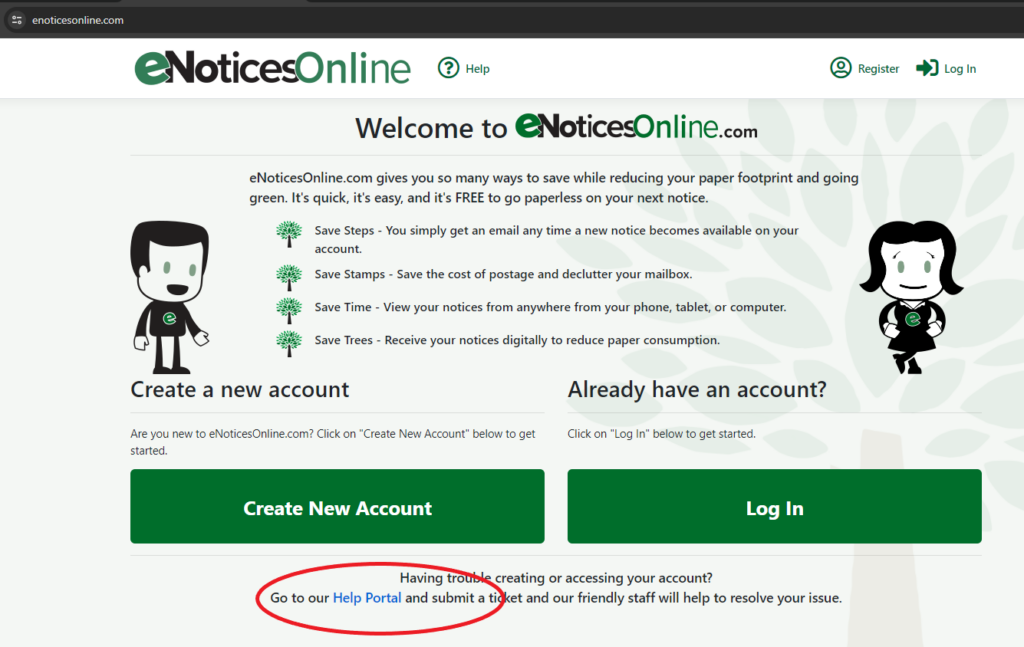

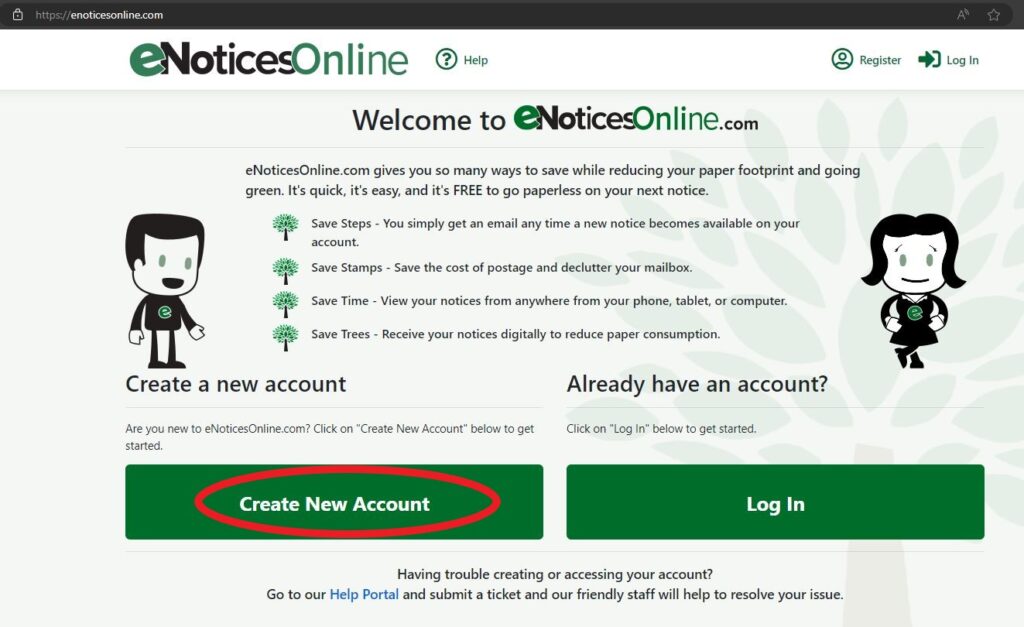

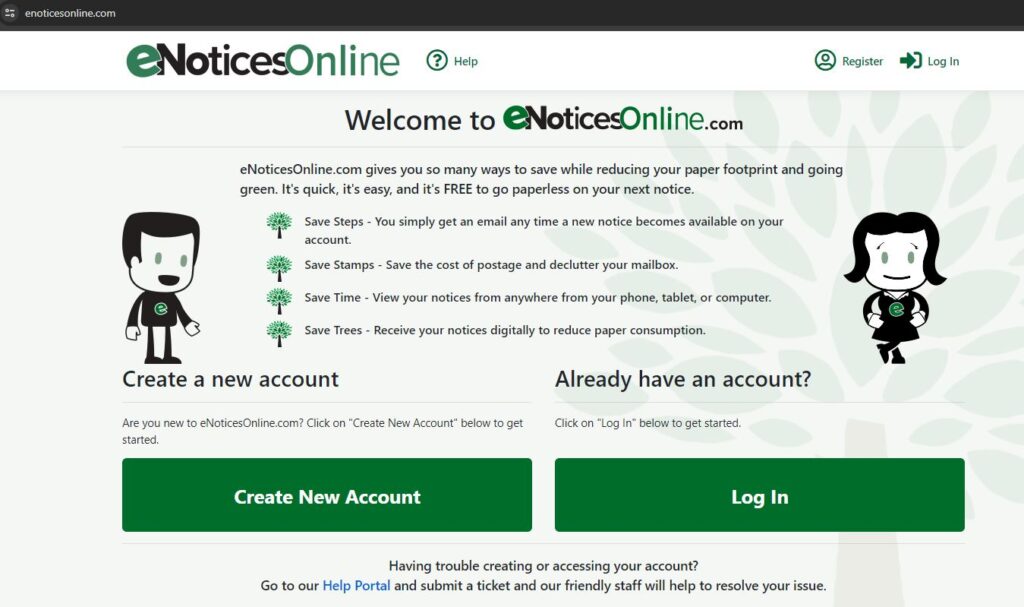

1. Go to eNoticesOnline

Go to eNoticesonline.com – Click Create New Account

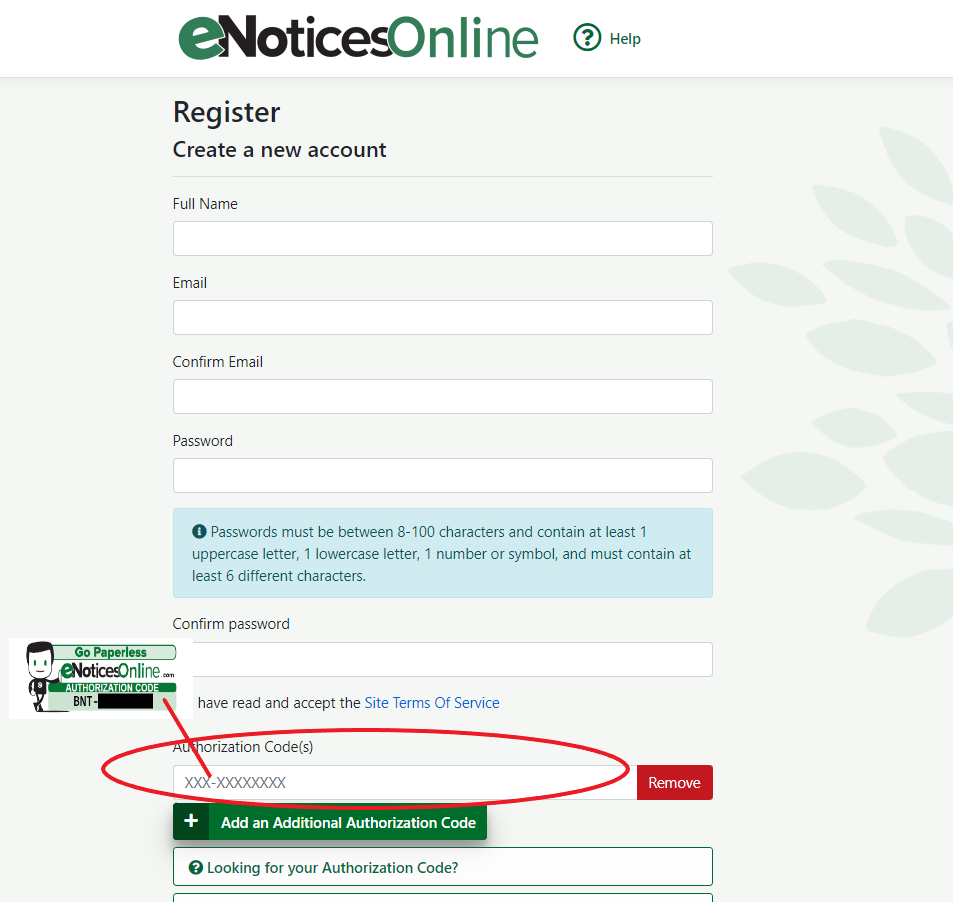

2. Register

Enter the Authorization Code that is located in the highlighted box on the letter we mailed.

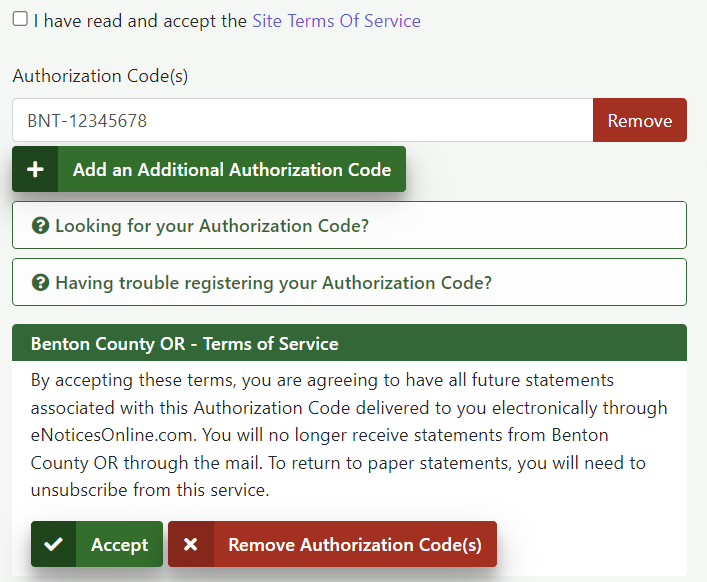

3. Accept terms

You will have to accept that future tax statements will be sent electronically. But you can opt out of this option once you have filed your return electronically and they will get sent by paper.

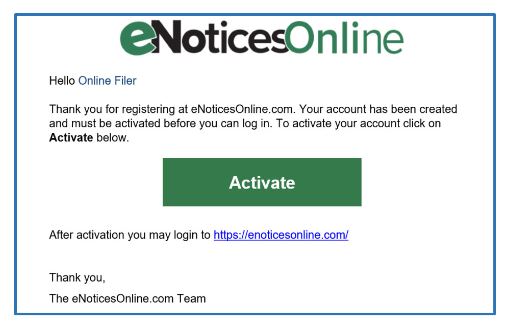

4. Activate

The final step of registration is to activate your account using the email notification eNoticesOnline will send to the email you used to register. If you do not receive the activation email, first check your spam folder, and then contact eNoticesOnline directly through the help menu.

You are now ready to navigate to eNoticesOnline.com and login through the member login Portal.

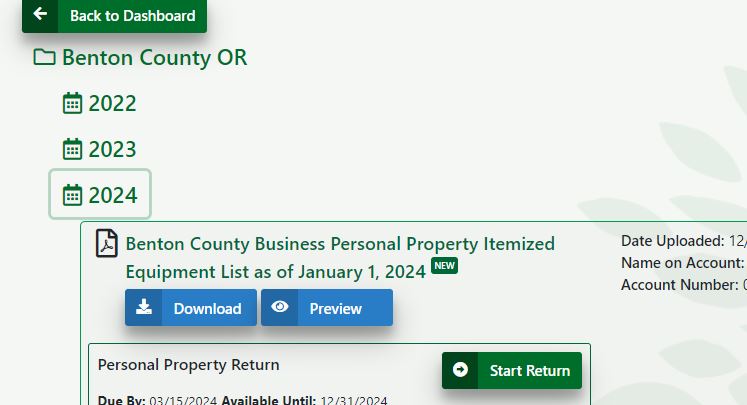

5. Review your Benton County Folder

Once you have logged in you will go to View Documents and you will see your “Benton County” folder. This is the repository where all of your documents will be stored. You will be able to see your previous asset lists.

Your folder will include:

• Personal Property Asset List: This allows you to download a copy of your current asset list. This asset list is for your use only and does not need to be returned to our office.

• Tax Statement: Your tax statement will be available electronically once they are released by the tax office. Your tax statement will be electronic unless you opt out and want a paper tax statement. If you don’t opt out an email will be sent notifying you when it is available.

• Start Return: You will use this form to add and delete assets for the current year and file your return electronically.

Contact Us

• If you have lost your authorization code or have filing questions please contact: Benton County Department of Assessment via email: personal.property@bentoncountyor.gov or telephone at 541-766-6269.

• For password issues, or functionality issues with eNoticesOnline please to help eNoticesOnline.com, or you can submit a ticket from the help menu on the eNoticesOnline homepage.